Changing Commercial And Social Conditions Spark Consumer Energy

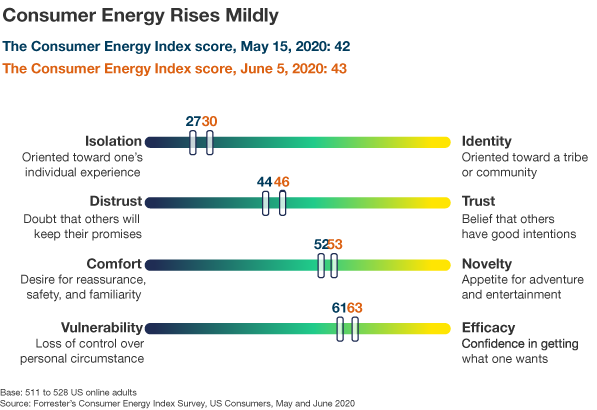

To measure precisely what kind of emotional toll COVID-19 is taking on consumers — and how current consumer sentiment will influence imminent behavior — we are applying Forrester’s Consumer Energy Index, our data-driven framework that captures how ready and willing consumers are to reach out to brands.

After dropping dramatically during the months of March and April as the COVID-19 pandemic became a harsh reality across the US, consumer energy among US online adults hovered at its lowest levels of the past two years. By mid-May, flickers of consumer energy signaled a growing consumer appetite to reengage with brands — particularly in suburban and rural areas.

Now, in early June, the conditions have changed drastically. Every US state has at least partially reopened, cases of COVID-19 are rising in certain districts while the overall US count falls, and the unleashing of activist sentiments has driven hordes of consumers to gather in protest. The most recent pulse of consumer energy shows a slight increase along all four dimensions:

What The Data Means

While the aggregate data serves as a useful baseline, a deeper analysis reveals critical differences in consumer energy across consumer groups. Most importantly, consumer energy varies by:

- Age: Younger consumers rally around brands with more gusto than older consumers. With a novelty score of 58, consumers ages 18–34 are particularly energized by new messages and experiences. With an identity score of 32, these consumers are also feeling connected to community groups more than they have over the past three months. On the other hand, even though consumers ages 55-plus maintain a strong willingness to trust people and organizations, a novelty score of 49 and identity score of 26 signal a desire to retreat to the familiar and a fading sense of group affiliation.

- Urbanicity: Consumer energy surges among urban consumers and wanes among rural consumers. In mid-May, consumers living in urban areas had a consumer energy score of 39; now, their score has risen to 44. Last month, consumers living in rural areas had a consumer energy score of 45; now, their score has dropped to 38. This is likely driven by optimism surrounding businesses that are reopening in areas that were most impacted by the pandemic.

- Political affiliation: Consumers who identify as conservative have higher energy scores than their liberal counterparts. While politically conservative consumers’ energy score — 43 — is fueled by rising trust and efficacy levels, politically liberal consumers’ energy score — 39 — is weighed down by low trust levels.

What This Means For Brands

As consumers begin to reengage in commercial exchange, they navigate conflicting emotions, such as optimism and caution. Additionally, increasingly sensitive values-based consumers are putting more pressure on brands not only to make a statement about their role in rising activist efforts but also to show real change through sustained action. In this tumultuous time, brands must speak to consumers in a way that respects the emotional tenor of the moment and that dials up consumer energy to encourage brand engagement. Marketers should consider their potential to move consumers up the scales of all four consumer energy dimensions — to foster a sense of shared identity, validate consumer trust, stoke optimism around change, and encourage consumers to act on their empowerment.

Questions, comments, or ideas? I look forward to sharing more data detail and discussing via inquiry.