Consumers React To Tariffs With Concern And Caution

“Liberation” Or Turbulence?

April 2 will be, according to the US administration, Liberation Day! While that does have all the makings of a Hollywood potboiler, in reality, it’s a little more sedate — well, only just a little more. On April 2, the US is supposed to introduce a slew of new tariffs, the details of which are shrouded in a fog of uncertainty and confusion that is now par for the course. In a brief preview of what liberation might look like, the US government has already declared a 25% tariff on imported cars. Markets are in turmoil; the Fed has cut growth rate forecasts and declared this a time of remarkably high economic uncertainty, while blue-chip companies are downgrading their financial outlook. It’s not quite Hollywood, but there’s drama nevertheless!

Tariffs Are Not A Crowd-Pleaser

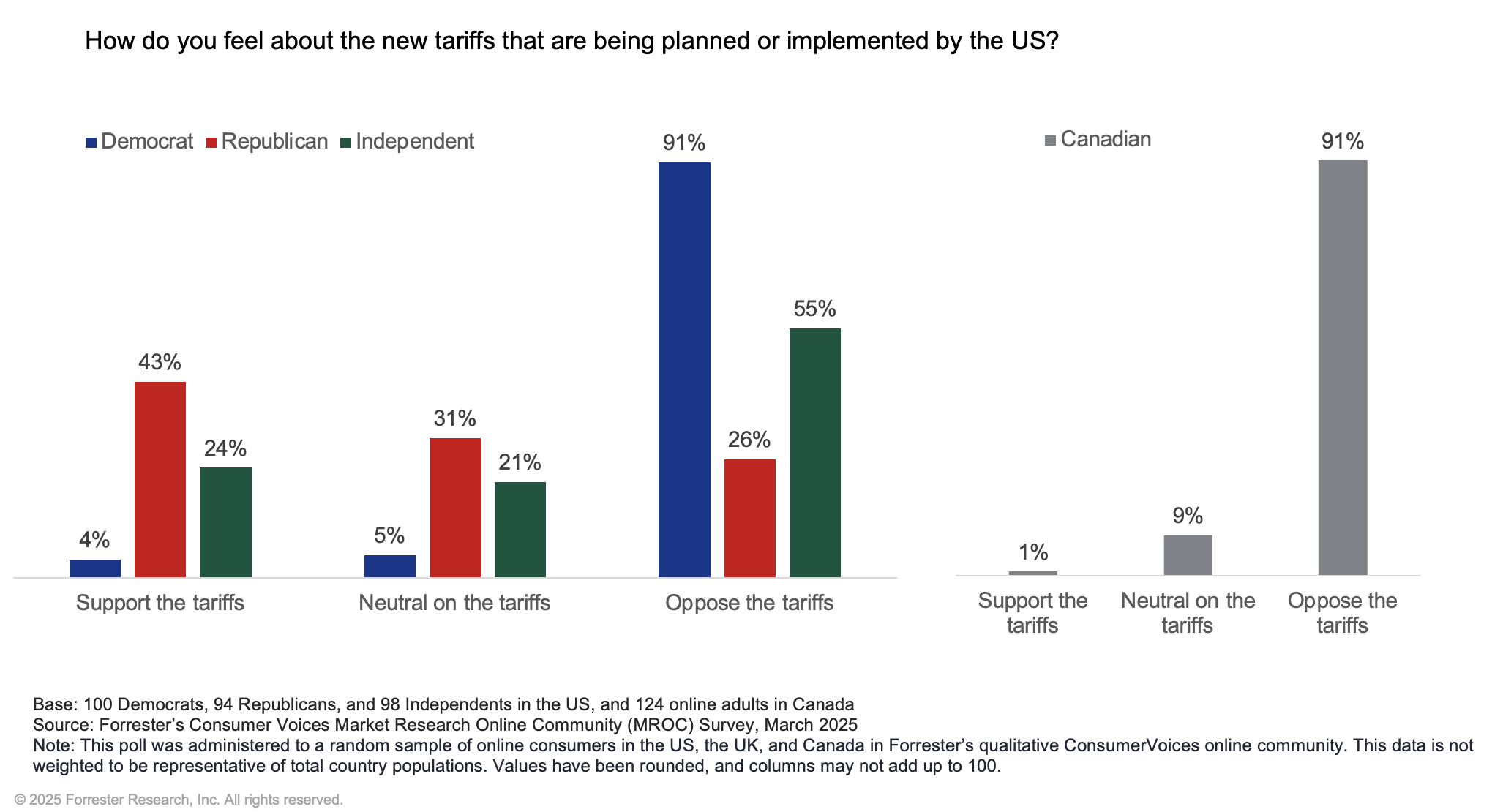

To understand how consumers are reacting to the constant chaos of tariffs, we polled Forrester’s CommunityVoices Market Research Online Community comprised of online adults from the US and Canada. As you might expect, opinions are polarized along party and national lines, but fault lines are beginning to emerge:

- Ninety-one percent of Democrats oppose the tariffs while 43% of Republicans support them; 4% of Democrats support the tariffs, and 26% of Republicans oppose them. This is a significant finding — Democrats are significantly more vocal in their opposition than Republicans are in their approval, suggesting that, for many, their pocketbook concerns (of which there are plenty) are beginning to outweigh their partisan convictions.

- Those without a political affiliation generally view these tariffs as a bad idea — a majority of Independents (55%) oppose tariffs, while only 24% support them.

- Canada has borne much of the US government’s ire and is, not surprisingly, vehemently opposed to the US tariffs — 91% of Canadian consumers oppose them and 9% are neutral.

Consumers Brace For Impact

In the face of uncertainty and imminent price increases after four years of sustained inflation, people are bracing for what is yet to come. As a result, consumers are (in their own words):

Reducing spending

“Cut back on spending on unnecessary items”

“Buying less often and more affordable products”

Saving more

“Saving, saving, saving; following a strict budget, only purchasing the necessities, and living below my means”

“I am trying to save more money, as the stock market keeps losing money due to the whiplash and uncertainty of the current administration”

Stocking up

“I have purchased items in bulk to stock up”

“Stocking up now on things that I need before the prices increase”

Avoiding major purchases

“I am currently avoiding major purchases, such as a car, due to already high prices”

“Holding off on large purchases”

Growing their food

“Growing my own food — getting chickens”

“Purchasing from farmers’ markets; filling my freezer now and preparing to plant a large garden”

Monitoring the situation closely

“At this point, I am just paying close attention to the news and what is going on”

“I am waiting to see what happens so I can react appropriately”

Canadian Consumers Push Back

An overwhelming majority of Canadians are miffed about the tariffs (among other things, such as the threat of annexation) and view these developments negatively (“The US will alienate its closest ally and trading partner”). There remains a small minority with hope of an amicable resolution: “We are neighbors with the US and always will be; it makes more sense to work together” and “There needs to be a compromise.”

In the meantime, they, like their southern neighbors, are changing their buying behavior by:

Avoiding US products

“Boycott products made in USA”

“I will no longer buy anything from American companies”

“I’m dumping the services I use that are American; that includes giants like Amazon”

Buying Canadian products

“Buy all-Canadian products”

“I will purchase more locally made products and use services from my country”

Being financially cautious

“I plan on cutting back on spending everywhere with everything”

“I will be buying fewer items that are not a necessity”

“Buying things in bulk and on sale”

“When something storable is on special, I will buy more”

“I will be trying to grow vegetables in my house and buying only food items”

To better manage your brand and business through this period of uncertainty and shifting consumer behaviors, please read our report: Consumer Marketing, CX, And Digital Leaders: How To Thrive Through Volatility (US).

(Tyler Castro contributed to the analyses and research for this post.)

Follow my work: Go to my Forrester bio and click “Follow.”

Chat with me: If you are a Forrester client interested in discussing these topics, please schedule time with me for an inquiry or guidance session.

Plan a session: If you are a Forrester client looking to host a strategy session on a related topic, please contact your account team or email me at dchatterjee@forrester.com.