Forecasting In Uncertainty: IMF World Forecasts Of Deeper 2020 Pandemic Recessions Foreshadow Weaker Tech Markets

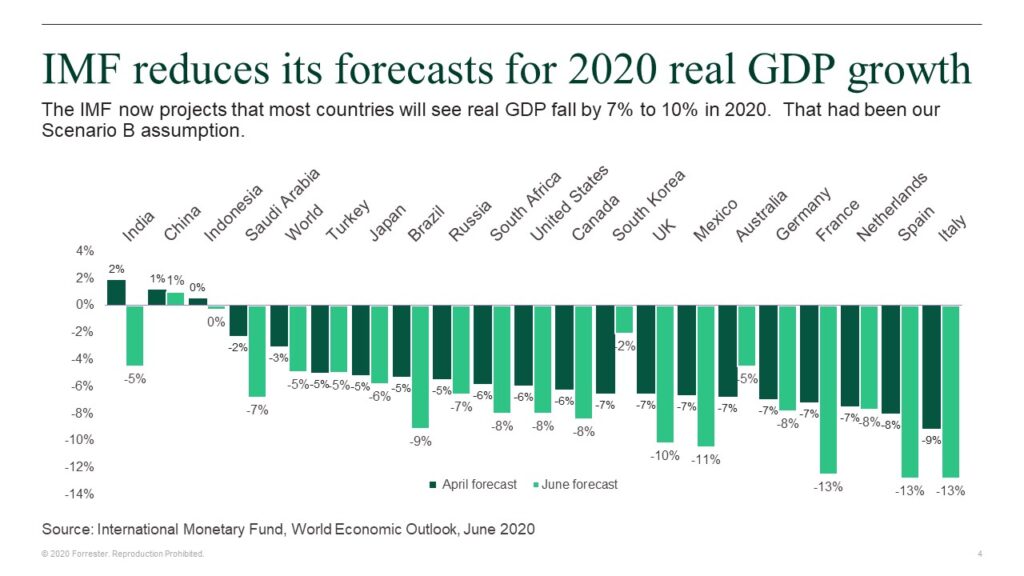

On June 24, the International Monetary Fund (IMF) released its updated forecasts for global and country economic growth (World Economic Outlook Update, June 2020). The updates to its April 2020 report show a deeper recession in 2020 and a shallower recovery in 2021 for the world economy as a whole, as well as for most countries (see figure below). Indeed, in most countries, the new growth numbers are close to what Forrester has been assuming as the economic conditions for Scenario B for global tech markets — that is, a deep recession in 2020 that lasts into 2021. With the exception of a few countries in the Asia Pacific region, these new forecasts do not support the short or V-shaped recession underlying Scenario A. The IMF did forecast modest recoveries in 2021 but ones that would only erase about half of the economic decline in 2020. And it again highlighted the uncertainties and risks around the 2021 outlook. Of course, these are just forecasts, and the IMF is just one of many forecasters, albeit one with the best access to the statistics of countries around the world. Still, the IMF forecasts at the country level are broadly in line with other forecasters, such as the consensus of forecasts published each week by The Economist magazine (see Economic & financial indicators, Jun 27th 2020 edition).

What The IMF Report Means For Tech Markets In 2020

Economic growth rates have a strong correlation with tech market growth rates. We still have to update our tech market forecast model to reflect the bleaker economic outlook. But it is safe to assume that global tech market growth in 2020 will be 2 to 3 percentage points lower than the -5% drop (in US dollars) that we had earlier projected for Scenario A (a short 2020 recession) in our April webinar (see WEBINAR: The 2020 To 2021 Tech Market Outlook At A Time Of Global Pandemic And Economic Recession). That means the probability of Scenario B, with its 8%-or-so drop in global tech purchases in 2020 measured in US dollars, is now over 75%. And 2021 is looking like a year with continued weak demand for tech goods and services.

That’s the overall outlook. But at the country level, there were both downgrades in the economic outlook for many countries — including the US — but upgrades or no change in other countries. These changes translate into the following outlooks for tech markets in the largest countries around the world.

- Much worse outlooks for Brazil, France, India, Italy, Mexico, Saudi Arabia, Spain, and the United Kingdom. The IMF forecasts for real GDP growth in these countries were 3.5 percentage points or lower than the April projections. Their economies are projected to shrink in 2020 by -9% to -13%. India has the biggest negative swing, with its economic growth shifting from +2% in the April forecast to -5% now; Saudi Arabia’s shift was almost as large, going from -2% to -7%. The downgrades in the economic outlook for Brazil, India, and Mexico are directly tied to raging pandemics in those countries and their failure to put in place effective containment efforts. Saudi Arabia has been hit by the steep drop in oil prices, as to a lesser degree has Mexico. France, Italy, and Spain have mostly been able to bring their pandemic under control but at a heavy economic cost. France’s weaker economy is a bit of a surprise given its aggressive economic stabilization program, but Gallic pessimism seems to be hurting business and consumer confidence. The UK’s lower GDP growth was more expected due to its delayed and ragged COVID-19 response and the broader uncertainties from Brexit.

- Deteriorating prospects for Canada, Russia, South Africa, and the US. The downward revisions in the IMF forecasts for these countries were around 2 percentage points, resulting in real GDP drops of -7% to -8% in 2020. Russia and South Africa are not big factors in the global tech market, but Canada and the US are. The US economy shows few signs of a strong recovery, and the COVID-19 pandemic is expanding across all the Southern states of the US even as the Northern states generally have it under control. The relaxation of containment efforts has led to some rehiring, but unemployment and underemployment remain dangerously high, consumers are extremely cautious, business investment continues to languish, and the prospects of additional economic stimulus programs have stalled. As a result, Scenario B, with its deeper and more prolonged economic downturn, is moving closer to becoming a certainty for the US. While Canada has done a better job of managing the pandemic and sustaining its economy, it is not likely to avoid the downward drag from its US neighbor.

- Little change in the tech market outlook for China, Germany, Indonesia, Japan, the Netherlands, and Turkey. China, of course, was the first country to experience the pandemic and, after a couple of months of downplaying its threat, then turned around and crushed it with an extensive lockdown. While it has seen occasional flareups of COVID-19, business activity has mostly returned to normal operations. But Chinese consumers remain wary, exports are weak, and overall economic growth will remain barely positive. Germany, Japan, and the Netherlands have in their own ways done a good job of containing the virus and limiting its economic damage. Steep declines in Q1 and Q2 mean that overall economic growth will be down for the year, but recoveries are likely starting in Q3. These four countries are thus strong candidates for experiencing Scenario A, with an economic and tech market recovery in the second half of 2020. Partly because of luck and partly because of some effective policies, Indonesia and Turkey have also contained the pandemic, with decent prospects of also experiencing Scenario A.

- Tech markets in Australia and South Korea will benefit from improvements in their economic outlooks. These two countries, along with Denmark, Finland, Iceland, New Zealand, and Norway, have been able to bottle up the pandemic and are starting to return to normal. As a result, the IMF now expects both countries to see relatively small drops in their economies, with much of the damage already done. They, too, are likely to experience Scenario A, with a pick up in economic growth and tech spending in the second half of 2020.

What The IMF Report Means For Tech Markets In 2021

The economic outlook and tech markets for 2021 still remain extremely hazy. The IMF has tentatively projected that many economies will see economic recoveries in 2021. And as the IMF acknowledges, recessions tend to feed on their own momentum, with even financially sound consumers and businesses saving rather than spending. Aggressive fiscal and monetary policies can help achieve that outcome but may not be adopted. Moreover, even if many economies do recover in 2021, the IMF’s projected growth rates for 2021 are mostly less than the 2020 declines. That would leave 2021 economic activity and tech spending still below 2019 levels.

There is one final implication of these forecasts, and it is a regional one. In general, and with exceptions such as India, Asia Pacific countries have done a good job of containing the pandemic and limiting the resulting economic downturn. European countries, with some exceptions, have done an adequate job of containing the pandemic, though at the cost of steep, (hopefully) relatively short recessions. But countries in the Americas (again, with exceptions) have so far neither contained the pandemic nor avoided deep and lasting economic damage. These patterns suggest that tech markets in the Asia Pacific region will recover first, European tech markets will come back (but weakly) in 2021, and tech markets in the Americas will still be at risk of declines in 2021.