ServiceNow And Atlassian: The Rise Of IT Management Platforms

As one of the Forrester analysts in attendance this spring at the ServiceNow Knowledge 2024 and Atlassian Team 24 conferences, I noticed a palpable change. Beyond the usual vendor conference experience (keynotes bookended by oppressively loud music, big show floors, and the general feeling of drinking from a fire hose), this year it became clear that we’re seeing a structural realignment in important sections of the IT management market.

I use the term “management” deliberately to call out those aspects of IT responsible for planning, constructing, delivering, operating, and controlling the vast technical portfolios — i.e., the actual IT capabilities, not the technology vendors, per se (the Dells, Oracles, and Amazons of the world).

Within that scope, ServiceNow and Atlassian have reached dominant positions as center-of-gravity IT management platforms. They occupy a strategic position in IT management as general-purpose systems in use across the full scope of IT portfolios (on-premises, hybrid, and cloud) to plan, create, deliver, and operate. They are now at a level of scale and momentum where no other competitor is likely to catch them — ServiceNow’s annual revenues in 2023 were $9 billion, and Atlassian’s were $3.5 billion, far ahead of competitors. They are both continuing to expand their scope into both IT and increasingly non-IT capabilities.

ServiceNow has had project management capabilities from its earliest days, but its main origins were in IT service management. Conversely, Atlassian started with Jira for tracking project requirements (now considered a collaborative work management tool by Forrester) and added its fast-growing Jira Service Management module in 2020, a direct competitor to ServiceNow. Both have moved into adjacent IT management market segments, including strategic portfolio management, value stream management, collaborative work management, incident management, and artificial intelligence for IT operations. The usual “best of breed vs. integrated suite” dynamics are playing out.

It’s not surprising that two IT service management (ITSM) supporting vendors have emerged as centers of gravity for IT management. ITSM has historically had the broadest operational reach of all the CIO’s areas, tracking knowledge work and assets. These platforms’ expansion has been ongoing for some time, but recently, AI and generative AI (genAI) have thrown gasoline on the fire. There is a positive feedback loop in the war for AI value: The data-rich platforms get richer much faster as their platforms attract more usage and data. Organizations are finding that retrieval-augmented generation architectures and large language models are hard and expensive — commercial platforms are going to have the advantage, clearly.

Many firms will run both for the foreseeable future. ServiceNow has a stronger low-/no-code platform and configuration management database-related capabilities, while Atlassian shines in supporting pro-code development teams and has a complete DevOps pipeline. But both are strong players in the collaborative work management and IT/enterprise service management markets, and increasingly, companies will have to consider carefully which one is a better fit.

So with all this, longtime followers and colleagues may ask, “Charlie, is this finally the long-promised ‘ERP for IT’ moment? The equivalent of ‘SAP for the CIO’?”

We’re certainly closer than we’ve ever been but with one major caveat: While both have strategic IT portfolio management, neither platform has IT finance. My view is that, without IT finance, we can’t call it “enterprise resource planning (ERP) for IT.” Apptio (now owned by IBM) is the strongest offering, and I think any M&A scenario bringing it together with ServiceNow or Atlassian is unlikely at best (but who knows?). ServiceNow at one point tried to build an IT finance capability but abandoned it and (for a time) ceded the market to Apptio.

Usual disclaimer on “ERP for IT”: It’s a useful challenge and provocation, and enough of us have been talking about it over the years that it’s a meaningful construct. But due to the baggage that ERP systems carry, per se, I do not recommend using it in marketing or internal communications.

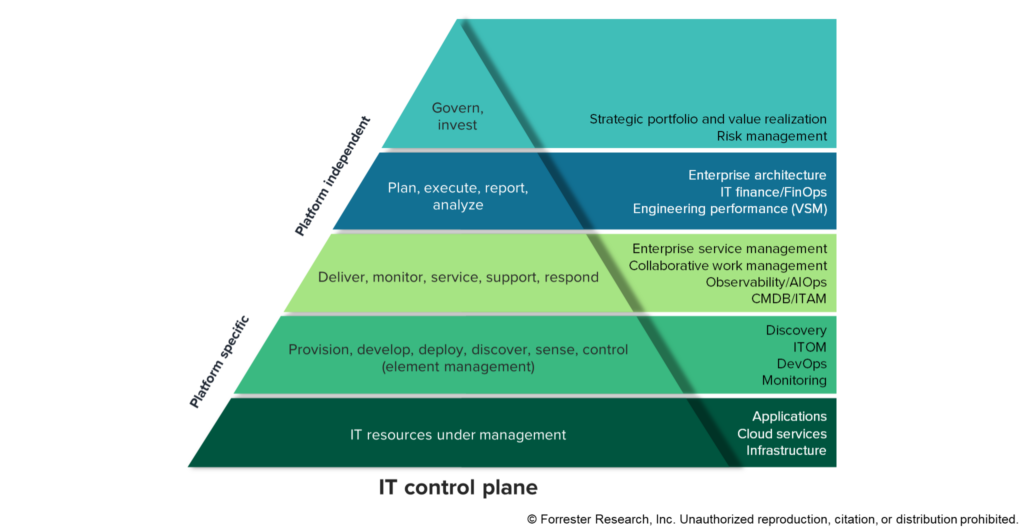

Finally, I want to take this opportunity to present our new visualization for what we (still provisionally) are calling the “IT control plane.” This is modeled explicitly on the same pyramidal paradigm used by the ANSI/ISA-95 reference architecture for manufacturing.

This is an alternate view to strongly lifecycle-influenced depictions such as IT4IT. I’m increasingly of the opinion that continuous flow practices are now so pervasive that we need to downplay the usual left-to-right lifecycle dimension in our visualizations. (Stop baking waterfall into the architecture.) Instead, what I see more and more is a hierarchy, like ANSI/ISA-95. The markets Forrester covers sort nicely this way; more on this to come.

In conclusion, this is a continuation of the overall IT management architecture work. Look for further reports on use cases, patterns, and the ongoing convergence of these key markets for IT leaders.

My colleagues, Julie Mohr, John Bratincevic, Margo Visitacion, and Andrew Cornwall, were in attendance and assisted with our new report, Vendors Move To Dominate IT Management Software: Navigating A Bipolar ServiceNow/Atlassian World.