Technology Service Provider Acquisitions: A Strategic Shift To AI And Industry Services Is Underway

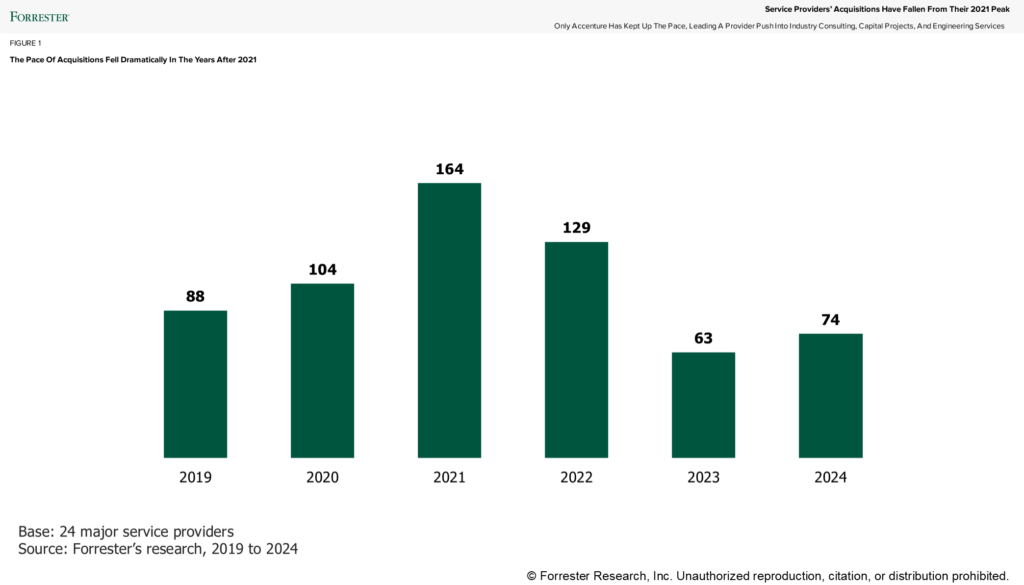

The number of acquisitions by 24 top service providers — including Accenture; Atos; Bain & Company; BearingPoint; Boston Consulting Group; Capgemini; CGI; Cognizant; Deloitte; DXC Technology; EPAM; EY; Globant; HCLTech; IBM; Infosys; KPMG; McKinsey & Company; NTT DATA; Perficient; PwC; Tech Mahindra; West Monroe; and Wipro — fell sharply from 164 in 2021 to 63 in 2023 and rebounded only slightly to 74 deals in 2024 (see the figure below).

Compared with 2020 and 2021, when the COVID response still drove most deals, three factors tamped down acquisition fever in 2023 and 2024, continuing to be slow in today’s volatile environment:

- High valuations: unrealistically high valuations that deterred acquisitions

- Demand trends: flat or slowly rising demand for technology services

- Interest rates: high interest rates that increased the cost of capital

Only Accenture kept up the pace: Over the past two years, Accenture accounted for almost half of the acquisitions tracked, adding 66 firms (and a forecasted 2–3% inorganic growth) to the 131 it acquired between 2019 and 2022. The next biggest acquirer in the period was Deloitte with nine deals — far off its pace of 55 between 2019 and 2022. This makes Accenture a bellwether for the expansion strategy of the services industry.

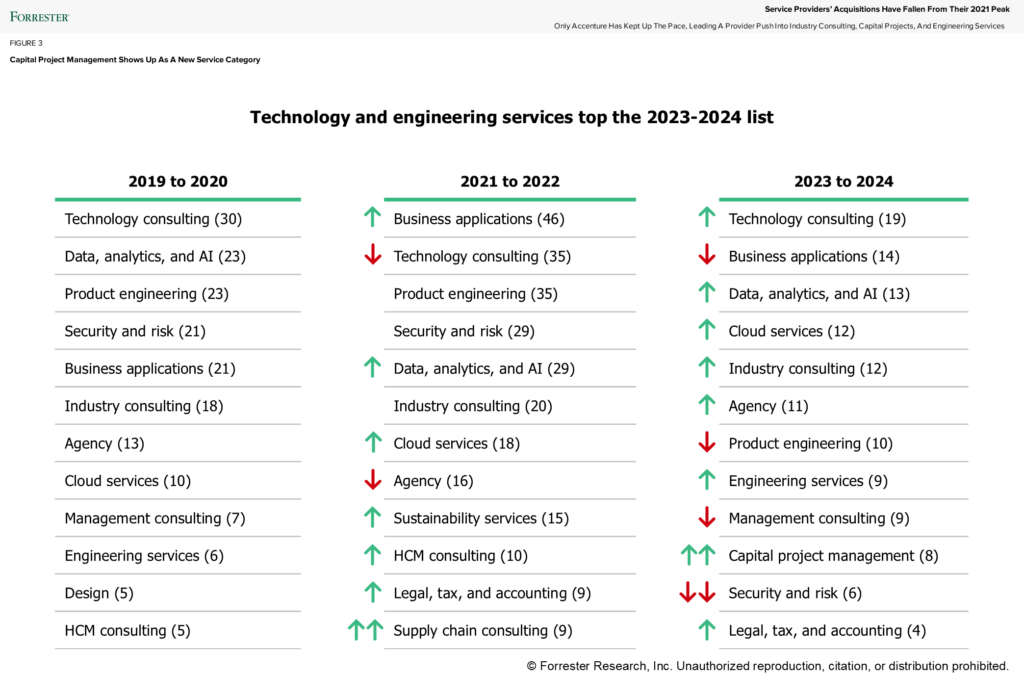

Providers Are Heading Toward New Kinds Of Services

Service providers continually reassess their best opportunities to expand. They acquire companies to enter new markets, introduce new lines of service, or expand capacity. All three reasons motivated providers in 2023 and 2024 to acquire firms in 12 categories (see the figure below). AI and data showed up in the deal categories, rising to number three in the lineup. That AI service purchase momentum continues (in a slow deals market) in 2025 with purchases of Hakkoda by IBM Consulting and Halfspace by Accenture, for example. In addition to AI, the acquisition pivots signal where providers are headed:

- Industry consulting services. Industry consultants are closer to an enterprise context than general systems integrators. For example, Globant acquired US-based ExperienceIT for its healthcare prowess; Accenture acquired Italy-based Intellera Consulting, focused on public sector and healthcare services.

- Business application implementation services. Services to implement Oracle, Salesforce, SAP, and Workday have been on the acquisition list for years. In 2023–2024, ServiceNow became a hot acquisition target: Cognizant acquired US-based Thirdera, EY acquired UK-based whyaye, and NTT DATA acquired Brazilian provider Aoop, all for their ServiceNow skills.

- Capital project management services. Providers are expanding into managing large infrastructure projects. Deloitte acquired Nihar in Australia, while Accenture acquired six firms providing infrastructure project services, including Boslan in Spain and Comtech Group in Canada.

- Training services. Training services have gained importance due to rapid workforce changes stemming from AI. Accenture joined Infosys in 2024 by acquiring Udacity and Award Solutions to expand its learning platform and services.

What Providers’ Acquisition Strategies Mean For Technology Executives

Companies depend deeply on the providers they hire. In Forrester’s Business And Technology Services Survey, 2024, enterprise services decision-makers said that, on average, their firm would spend 28% of its IT budget on third-party service providers in 2024. This means that they must care about key providers’ strategies, including their approach to acquisitions and track record of success (or quiet failure). Ask your strategic partners about their:

- Acquisition strategy. What is the provider’s acquisition strategy, and how will it support your evolving needs? Make their acquisition strategy part of your vetting process and annual master service agreement review.

- Impact on existing work. How will a particular acquisition affect the work you’re already doing with the provider? If you are already working with the acquired firm, ask it directly. If not, ask for an introduction to get the straight scoop on the acquirer’s plan.

- Contract protection. Procurement professionals should write contracts that protect against the provider being acquired and investigate any changes stemming from an acquisition that could affect the validity of the contract.

For the in-depth report, click here.

(Thanks to my colleagues Hannah Murphy and Hayden Weatherall for this research foundation.)