The UK’s Digital Banks Are Giving Established Banks A Run For Their Money

Digital banks have disrupted the status quo. Retail banking in the UK has more competition from digital banks than almost any other market, with small business banking a close second. Nearly a dozen new digital banks, including Atom Bank, Monzo, N26, Revolut, Starling Bank, and Tandem, are competing for retail customers, aiming to differentiate by using mobile to offer simple, convenient, and more personalized customer experiences. The most successful digital banks are now winning millions of customers. Monzo has just announced that it has 3 million customers in the UK.

Digital banks have disrupted the status quo. Retail banking in the UK has more competition from digital banks than almost any other market, with small business banking a close second. Nearly a dozen new digital banks, including Atom Bank, Monzo, N26, Revolut, Starling Bank, and Tandem, are competing for retail customers, aiming to differentiate by using mobile to offer simple, convenient, and more personalized customer experiences. The most successful digital banks are now winning millions of customers. Monzo has just announced that it has 3 million customers in the UK.

So how good are the digital banks’ services when compared with established banks?

To find out, we reviewed both the functionality and user experience of eight leading UK mobile banking apps. We’ve published the results of our reviews in “The Forrester Banking Wave™: UK Mobile Apps, Q3 2019.” We reviewed four established high-street banks: Barclays, Lloyds Bank, Nationwide, and NatWest; one established direct bank, First Direct; and three new-ish digital banks, Monzo, N26, and Revolut. Here are the highlights of what we found:

- Monzo and Barclays currently have the best mobile banking apps in the UK. Monzo and Barclays tied for the lead among the apps we reviewed. The two apps do different things well, but both combine strong functionality with a well-designed user experience.

- Barclays offers the best payments and money management capabilities. Barclays has packed its app with useful features, such as showing your upcoming bills on a calendar, helping you set up spending controls, and letting you store statements and other documents in a digital vault. The app is also easy to use, helping customers to avoid mistakes and making it easy to reach human help when you need it.

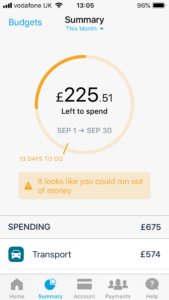

Monzo stands out for its intuitive money management. Monzo automatically categorizes your transactions, adds information such as the locations and logos of merchants, shows you how much you have “left to spend” in the current month, and automatically summarizes your spending while abroad when you return from a trip. The app is also easy to use. For example, Monzo uses clear language to explain what it does with your data. Monzo makes it easy to get help through both its combined help/search feature and chat with its customer service agents.

Monzo stands out for its intuitive money management. Monzo automatically categorizes your transactions, adds information such as the locations and logos of merchants, shows you how much you have “left to spend” in the current month, and automatically summarizes your spending while abroad when you return from a trip. The app is also easy to use. For example, Monzo uses clear language to explain what it does with your data. Monzo makes it easy to get help through both its combined help/search feature and chat with its customer service agents.- Digital banks are not all the same. We found just as much variation in the quality of the experiences delivered by the digital banks as we did among the established banks. Having no branches doesn’t necessarily mean a bank has better mobile banking services.

- The digital banks are moving fast. In the space of just a few years, the digital banks have built mobile services that match or exceed those offered by the large UK high-street banks. They are fast. As we’ve found in other parts of the world, many traditional banks just can’t keep up.

Forrester clients can read more in the full report.

So what does it mean? I’ll draw three lessons here: one strategic, one operational, one tactical.

- Strategy. If the digital banks can continue to iterate and win customers at the same pace, they will leave most traditional banks far behind. As this disruption spreads into small business and corporate banking, that will undermine traditional banks’ profitability and, eventually, viability.

- Operations. Banks’ digital teams need to embrace approaches like Agile development and design thinking if they are to innovate at pace. Legacy thinking and processes are as big a challenge as legacy technology.

- Tactics. There are some obvious functionality gaps, like search and alerts, and user experience flaws, like clumsy navigation, in the mobile banking services of most UK banks.

I hope you found that useful. Let me know what you think.